News | July 24, 2023

Canadian commercial real estate market strong despite tumultuous year

Why the Canadian commercial real estate market continues to be an attractive investment opportunity for institutional investors

Last year was a tumultuous year for investors in Canada and abroad. Just as the world recalibrated in the aftermath of COVID-19, global markets were rocked by, among other things, the war in Ukraine. As supply chain pressures continued, these market disruptions resulted in a year mired with increased food and energy prices – factors adding to inflationary stresses that ultimately pushed central banks to respond with significant interest rate hikes.

In Canada, the Bank of Canada responded in March 2022 with interest rate increases that have pushed the central bank’s overnight lending rate from 0.25% to 5.00% as of July 12, 2023. While higher interest rates, inflationary pressures, and market volatility have been challenging for commercial real estate markets to navigate globally, the underlying fundamentals continue to be strong for most real estate sectors in Canada.

This article examines why Canadian commercial real estate remains an appealing investment opportunity, notwithstanding the challenges the global market has endured. The conclusion is simple: there are unique supply and demand drivers that bolster the resilience of Canadian real estate. These drivers and associated resilience are why Canadian real estate is expected to remain an attractive investment opportunity for institutional investors.

Positive demographic trends

Canadian demographic trends continue to directly positively impact the long-term strength of the Canadian real estate market. Canada’s population growth, supported by accommodative immigration policy, is among the highest in the developed world.

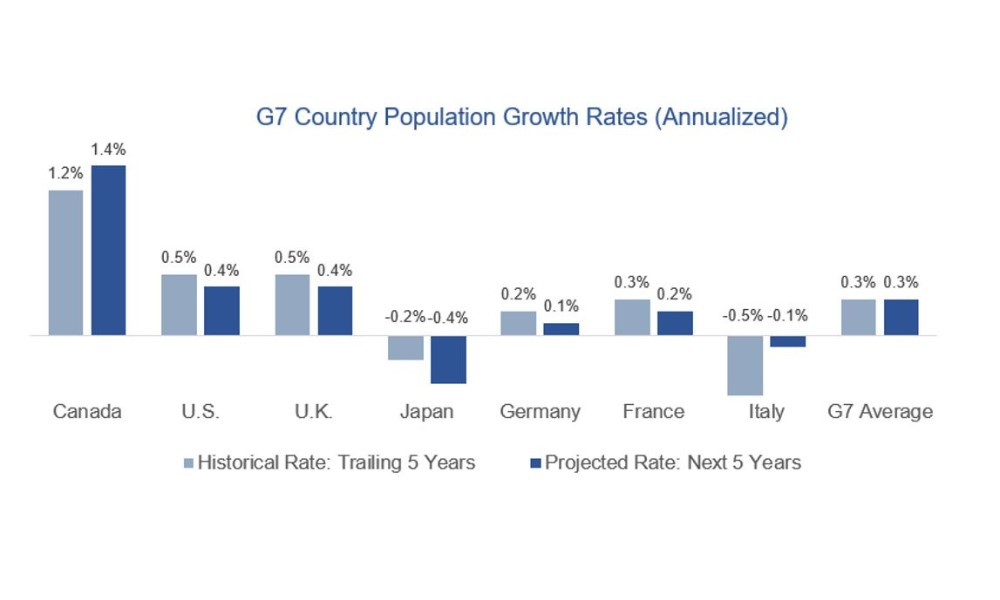

As the following chart illustrates, Canada’s growth has far outpaced other G7 countries over the past five years. Canada’s annualized population growth of 1.2% was more than double that of the US and the UK, and more than five times that of Germany. Most notably, this growth is expected to continue to outpace all other G7 countries over the next five years.

Like many developed countries, Canada is experiencing a lower birthrate, an aging population, and a shrinking workforce. To counter this decline, Canada has relied on targeted, expansive immigration policy. As the chart above captures, Canada is the only G7 country whose projected rate of population growth over the next five years is expected to increase.

The most recent projections released by Statistics Canada in June 2023 indicate that Canadian population has currently reached 40 million. Current projections estimate that Canadian population could almost double to 74 million, by 2068. In contrast, the US population is expected to grow by only 25% over that same period. These policies ensure continued robust demand across real estate types (multi-residential, industrial, storage, student housing, manufactured homes, retail, etc.).

Canadian real estate supply constraints – Canada vs. United States

In contrast to the positive demographic outlook, Canadian supply of new commercial properties has consistently lagged that of other major markets, like the United States, due to the following factors:

- Conservative lending environment: Canadian lenders (primarily large Canadian banks and insurance companies) historically have applied much tighter credit requirements. Lending guidelines will require materially lower loan-to-value ratios, shorter terms, and higher debt service coverage ratios than would be required for similar projects in the US. This has limited the ability of the Canadian industry to finance more (speculative) development.

- Restrictive legal system: Canada has tougher bankruptcy enforcement rules, which grant lenders stronger rights to protect the underlying property values.

- Recourse to borrowing entities: Canadian lenders typically require full or material recourse to all the borrowers’ assets and other properties. This has historically limited the number of real estate defaults and loans losses in Canada but has also prevented many developers from starting new developments given the material risk to them personally if there is a default.

- Concentrated financial services sector: the Canadian financial sector is dominated by a small number of large, well-capitalized banks and insurance companies. This industry structure limits the competitive landscape in Canada and further dampens new loan growth for commercial real estate development.

- Other factors: additional factors such as more rigorous zoning regulations and limited tax exemptions limit the number of new real estate development projects.

These supply constraints have created a real estate market in Canada with fewer historic defaults and loan losses. However, these constraints ultimately discourage speculative and risky investment in Canada, which adds to the relative strength of the real estate market overall and makes the Canadian market more resistant to prolonged corrections than other markets. This resilience was evident in 2009, following the credit crisis, where US and European countries experienced a sharp decline, while the Canadian market avoided any serious impact.

The Canadian commercial real estate outlook

Overall, one can expect the Canadian real estate market to remain strong with certain segments of the market more likely to outperform:

- The ‘Middle-Market’ – Properties/projects managed by best-in-class local operators and builders benefit from the supply and demand dynamics noted, but with less competition at the time of investment. Additionally, larger development projects can take up to 10 years to complete, adding to the risk. In contrast, smaller properties (less than $5 million) attract less sophisticated, experienced operators. Well managed mid-market commercial properties often offer better yields and investment returns, often with less risk.

- Specialty Sectors – Certain specialty sectors such as self storage, student housing, and manufactured home communities, disproportionately benefit from strong demographic trends. These sectors have performed very well over the last few years and should continue to remain attractive long-term investments.

- Multi-Family – Multi-family residential properties continue to be an attractive sector, due to robust demand and low vacancy rates. National vacancy rates were ~2% on average in Q1 2023. Projected strong population growth should continue to fuel strong demand into the future.

- Industrial – The industrial sector also exhibits low vacancy rates, currently sitting at 2.1% for Q1 2023 (CBRE). Demand is expected to remain strong as distribution and warehousing needs continue to grow in step with onshoring and e-commerce growth.

- Essential Retail – Occupancy levels at neighbourhood shopping centres, often anchored by essential food retailers or drugstores, tend to more resilient, even in tougher market environments. These more resilient sub-sectors currently have vacancy levels of about half that of large retail malls.

Despite the challenges presented in the last few years, the Canadian real estate market remains one of the strongest and most resilient in the world. With strong continued population growth, driving demand, numerous supply constraints, and a supportive economic environment, Canadian real estate is expected to continue to be an attractive investment opportunity for institutional investors for years to come.